A policy concept known as the COLA Cap Proposal Targets High-Earning Seniors is drawing increasing attention in Washington as lawmakers search for ways to reinforce Social Security’s long-term finances. The proposal would limit annual cost-of-living adjustments (COLAs) for retirees receiving the highest benefit amounts.

Supporters say the plan would strengthen the program by slowing benefit growth at the top, while critics warn it could undermine the integrity of earned benefits for Americans who contributed more over their lifetimes.

COLA Cap Proposal Targets High-Earning Seniors

| Key Fact | Detail / Statistic |

|---|---|

| Purpose of proposal | Cap annual COLA increases for high-benefit recipients |

| Potential long-term savings | Tens of billions over several decades |

| Impact on most retirees | No change for average or below-average beneficiaries |

| Trust fund outlook | Possible depletion within the next decade absent reform |

| Most affected group | Top 15–25% of benefit recipients with the largest payments |

Why the COLA Cap Is Emerging Now

The Social Security program, which provides critical income to more than 70 million Americans, is facing a historic fiscal challenge. Federal trustees project the retirement trust fund could be exhausted within a decade. After depletion, incoming payroll taxes would cover only about 77% of scheduled benefits.

This looming shortfall has prompted renewed debate over how to stabilize the system. While many proposals involve increasing payroll taxes, adjusting retirement ages, or modifying benefit formulas, others focus on more incremental changes—like limiting COLA increases for top earners.

“The COLA Cap Proposal Targets High-Earning Seniors is part of a broader menu of options under consideration,” said Dr. Karen Doyle, a policy economist at Georgetown University. “It is a way to slow long-term benefit growth without affecting those who rely most heavily on Social Security to meet basic needs.”

How COLA Works—and Why It Matters

The Current System

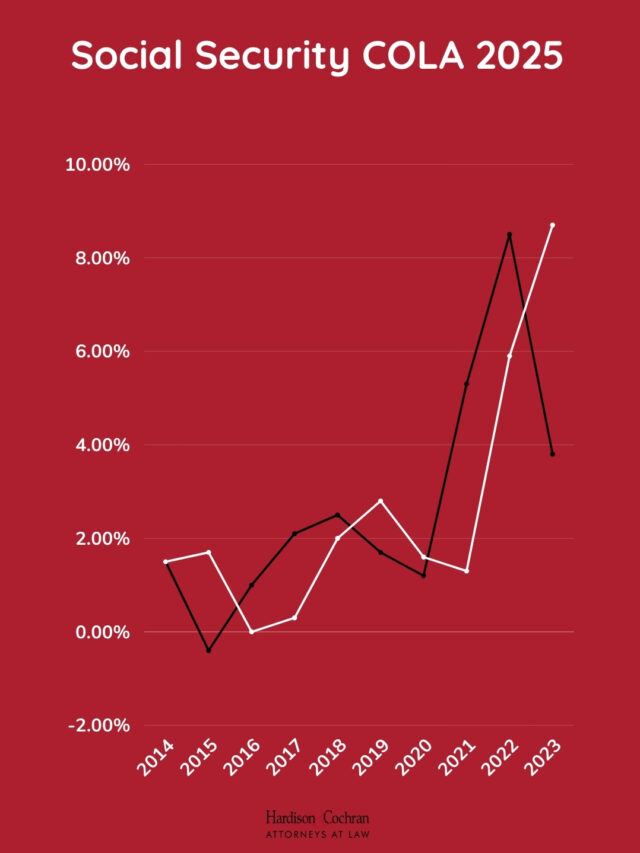

Social Security’s annual COLA is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a federal inflation measure. Each year, benefits are adjusted to prevent purchasing power from eroding.

The Debate Over CPI-W

Critics argue CPI-W does not reflect seniors’ true expenses, because it prioritizes categories like transportation and apparel rather than healthcare or housing.

Many policy experts argue for switching COLA to the CPI-E, a senior-focused inflation measure that typically produces slightly higher increases. A COLA cap proposal could conflict with this longstanding push.

“Using the CPI-W already understates seniors’ real inflation,” said Nancy Demers, policy analyst at the National Council on Aging. “Adding a cap would widen that gap for high-benefit retirees.”

What a COLA Cap Would Actually Do

A COLA cap would limit annual benefit increases for retirees with high monthly payments. Policymakers are exploring several possible approaches:

Option 1 — Percentile-Based Cap

Set a threshold at the 75th or 80th percentile of benefit levels. Anyone above the line receives a reduced COLA.

Option 2 — Dollar-Based Cap

Allow full COLA up to a specific dollar amount and cap any increase above that.

Option 3 — Phase-In Structure

Apply gradually reduced COLA rates as benefits rise above certain thresholds.

Option 4 — Applied Only to New Retirees

Minimizes impact on current beneficiaries but achieves slower savings.

Federal analysts say this approach could produce “meaningful long-term savings” while avoiding universal cuts.

Who Would Lose Out Under the Proposal?

High-Benefit Retirees

These are seniors who receive the largest checks, usually due to:

- High lifetime earnings

- Work histories above the taxable maximum

- Delayed claiming until age 70

- Dual-earner households

- Long careers in high-paying sectors (medicine, finance, engineering)

They often receive monthly benefits between $4,000 and $5,100.

Why They Would Notice the Change

Even a small reduction in COLA compounds over time. A retiree receiving $5,000 per month could lose tens of thousands of dollars in projected lifetime benefits under a strict cap.

Groups Not Expected to Be Affected

Most retirees fall below the cap threshold, including:

- Early retirees

- Workers in lower-paying or part-time jobs

- Service-sector workers

- Seniors receiving survivors or spousal benefits

- Disability beneficiaries in most scenarios

In many models, up to 75–80% of beneficiaries would see no impact.

Arguments For and Against the COLA Cap

The Case for the Cap

Supporters argue:

- It targets cuts toward the beneficiaries best able to absorb them.

- It slows long-run costs without reducing base benefits.

- It protects low-income beneficiaries from broader cuts if Congress delays action.

- It mirrors the progressive structure of the existing benefit formula.

- It helps delay trust fund insolvency, preserving time for broader reforms.

“Targeting COLA adjustments is less disruptive than cutting core benefits,” said Dr. Samuel Rios, economist at the Brookings Institution.

The Case Against the Cap

Critics warn:

- It breaks the long-standing link between lifetime earnings and benefit growth.

- It may set a precedent for future cuts.

- It reduces benefits even for seniors with high medical expenses.

- COLA already lags seniors’ real inflation, especially in healthcare.

- Alternative revenue reforms could raise solvency without cutting growth.

Senior organizations argue strongly against the proposal. The AARP states that “COLA is not a luxury—it is an essential protection against inflation for all seniors, regardless of earnings.”

Historic Precedents for COLA Changes

The U.S. has modified Social Security inflation adjustments before:

- 1970s: Introduction of automatic COLA adjustments.

- 1983 Reform Act: Temporary COLA delays as part of solvency fix.

- 1990s: Chained CPI considered but rejected due to senior impact.

- 2010 & 2011: Zero COLA years due to low inflation, widely criticized.

The new proposal would be the first change targeting only high earners.

How Other Countries Handle Pension Inflation

A comparison shows varied strategies:

- United Kingdom: “Triple lock” increases the state pension by inflation, wage growth, or 2.5%—whichever is highest.

- Canada: Uses a CPI-based measure similar to the U.S.

- Germany: Adjusts benefits using wage growth formulas.

- Japan: Applies a “macroeconomic slide” that reduces growth to stabilize finances.

The U.S. COLA cap proposal resembles systems that moderate benefit growth for upper-income retirees.

Public Reaction and Political Landscape

A recent survey by the Pew Research Center found that:

- 61% of Americans support protecting low-income retirees from benefit cuts

- 45% support limiting benefit growth for high earners

- Only 23% favor across-the-board benefit cuts

- 72% support raising taxes on high earners instead

Members of Congress remain divided. Fiscal conservatives express interest, while others warn the cap could face strong political resistance.

Experts Warn of Fraud Risks Amid COLA Discussions

Whenever Social Security changes are debated, scammers often exploit confusion. The Federal Trade Commission (FTC) warns of:

- Fake phone calls claiming “COLA recalculation required”

- Scammers requesting bank account updates

- Emails promising “bonus COLA checks”

The SSA does not call, text, or email recipients to request personal information.

What Retirees Should Do Now

Experts recommend:

- Monitoring official SSA updates

- Reviewing financial plans with advisors

- Avoiding reliance on unverified social media claims

- Understanding that any COLA cap change would require an act of Congress

- Recognizing that proposals often undergo major revisions before passage

Related Links

SSA November Payments — Four Important Dates and Eligibility Details to Know

$1,450 Stimulus Still Available — Families Can Apply Before December Deadline

As lawmakers intensify negotiations over Social Security’s long-term stability, the COLA Cap Proposal Targets High-Earning Seniors offers one potential path to slowing benefit growth while protecting the most vulnerable retirees.

Whether Congress embraces this targeted approach—or opts for revenue increases, broader benefit changes, or a combination of reforms—remains uncertain. But with the trust fund depletion date approaching, the debate over COLA adjustments is likely to become a central focus in the years ahead.

FAQ About COLA Cap Proposal Targets High-Earning Seniors

Q: Will average retirees lose their COLA?

No. Most versions of the proposal protect average beneficiaries.

Q: When would the cap take effect?

No date is set. The proposal has not yet been formally introduced.

Q: Does this change base benefits?

No. It would affect only future COLA amounts for high earners.

Q: Could the cap expand over time?

Possibly. Critics fear it could be broadened later, depending on fiscal pressures.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores