Analysis of 10 Major Retailers Reveals the Cheapest Ground Beef Prices

A wide-ranging analysis of ten major U.S. retailers reveals where to find the cheapest ground beef prices, with discount grocer Aldi and big-box giant Walmart leading the pack. The report highlights how store models and persistent food inflation impact consumer costs.

In an environment of persistent food inflation, a new market analysis of ten major U.S. retailers found that discount grocer Aldi and big-box retailer Walmart consistently offer the cheapest ground beef prices. The survey highlights a significant price disparity across stores for the popular staple, with consumers potentially paying over 70% more for similar products depending on where they shop.

Cheapest Ground Beef Prices

| Retailer Category | Average Price (80/20 Ground Chuck, per pound) | Key Finding |

| Discount Grocers (Aldi) | ~$4.29 | Consistently the lowest price point in the survey. |

| Big-Box Retailers (Walmart, Costco) | ~$4.48 – $4.79 | Highly competitive, with bulk options at Costco offering lower unit costs. |

| Conventional Supermarkets (Kroger, Safeway) | ~$5.49 – $6.29 | Prices are often influenced by weekly sales and loyalty programs. |

| Premium Grocers (Whole Foods) | ~$7.29+ | Highest prices, reflecting organic or specialty attributes. |

Unpacking the Rankings: Where to Find Savings on Beef

The comprehensive market basket analysis, conducted across multiple states in the third quarter of 2025, focused on the price per pound for 80/20 ground chuck, a common choice for American households. The findings reveal a clear hierarchy in retail pricing for this grocery essential. Discount chain Aldi emerged as the overall price leader, with an average price of $4.29 per pound. Its low-overhead business model, which includes a smaller store footprint and a focus on private-label brands, allows it to maintain lower prices across many categories. Close behind was Walmart, with prices averaging $4.48 per pound. As the nation’s largest grocer, Walmart’s immense purchasing power and efficient supply chain enable it to exert significant downward pressure on prices, making it a top contender for budget-conscious shoppers.

“The business model of the retailer is the single most significant factor in everyday shelf price,” said Dr. Michael Swanson, an agricultural economist and consultant. “Discount formats and large-volume retailers like Walmart and Costco can negotiate better terms and pass those savings to the consumer, whereas traditional supermarkets have higher operating costs that are reflected in their pricing.”

Costco also ranked favorably, though its model requires purchasing in bulk, typically in packages of five pounds or more. While its per-pound price was competitive at around $4.79, the upfront cost is higher. Conventional supermarkets like Kroger and Safeway occupied the middle tier, with prices often fluctuating based on weekly promotions.

What Drives the Beef Cost at the Counter?

The price a consumer pays for ground beef is the result of a complex journey from farm to fork. While retailer strategy is key, several other elements contribute to the final beef cost.

Lean-to-Fat Ratio and Quality

The lean-to-fat ratio is a primary price driver. The 80/20 blend (80% lean, 20% fat) is a popular standard, but other options are available. A 73/27 blend is often cheaper due to its higher fat content, while leaner blends like 90/10 or 93/7 command a premium.

Furthermore, specialty attributes significantly increase the price. Products labeled “grass-fed,” “organic,” or “no antibiotics” can cost several dollars more per pound, a market segment where premium grocers like Whole Foods Market specialize.

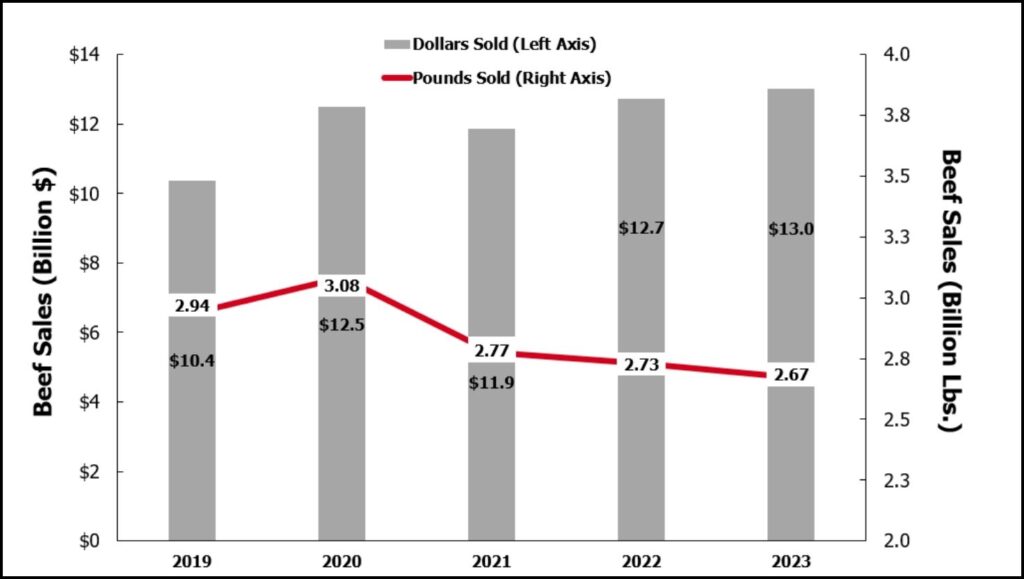

Broader Trends in Food Inflation

The price of beef does not exist in a vacuum. It is heavily influenced by broader food inflation, which has remained a concern for consumers. According to the U.S. Bureau of Labor Statistics (BLS), overall food prices have seen persistent increases over the past two years.

“While the headline inflation rate may be moderating, costs for producers, especially for feed and transportation, remain elevated,” stated a recent report from the American Farm Bureau Federation. “Drought conditions in key cattle-producing states have also constrained supply, putting upward pressure on prices for all cuts of beef.”

Data from the U.S. Department of Agriculture (USDA) confirms this trend, showing that the farm-to-retail price spread for beef has widened, indicating that costs are being added at the processing and retail stages.

Strategies for Shoppers Amid High Grocery Prices

For consumers looking to manage their grocery bills, the analysis provides clear takeaways. Beyond choosing a lower-cost retailer, experts suggest several strategies. Buying in bulk, when feasible, can offer savings, as can choosing less-lean ground beef for dishes where the fat can be drained off. Shoppers should also pay close attention to weekly flyers and digital coupons, as traditional supermarkets frequently offer ground beef as a “loss leader” to draw customers into the store.

Looking ahead, most analysts expect grocery prices to remain elevated compared to pre-pandemic levels. While the pace of inflation may slow, ongoing supply chain pressures and climate factors mean that finding the best value will remain a priority for households. The current retail landscape suggests that for the foreseeable future, discount and big-box stores will continue to lead on price for staples like ground beef.

How Aldi Peanut Butter Cups Became the Snack Shoppers Can’t Keep in Stock