$400 Stimulus Checks Rolling Out This Month — Who’s Eligible and When Payments Will Arrive

The State of New York has begun issuing $400 inflation relief checks as part of a statewide initiative to help residents manage rising living expenses.

$400 Stimulus Checks Rolling Out This Month

| Key Fact | Detail |

|---|---|

| Maximum Payment | Up to $400 per eligible household |

| Estimated Recipients | Around 8.2 million taxpayers in New York |

| Payment Timeline | September through November 2025 |

| Eligibility Basis | 2023 New York State income tax filings (Form IT-201) |

State Stimulus Effort Aims to Offset Inflation

Unlike federal stimulus programs funded by Congress, these checks come directly from state resources—a one-time refund initiative financed through New York’s 2024 budget surplus, which exceeded projections by nearly $2 billion.

Governor Kathy Hochul said the payments were a way to “return taxpayer dollars to the people who earned them,” emphasizing fiscal prudence alongside relief.

“This is targeted, responsible relief for working families,” Hochul said in a statement. “We’re using our strong fiscal position to help those still struggling with the lingering effects of inflation.”

Who’s Eligible for the $400 Relief Payment

The payments are automatic for residents who meet specific filing and income criteria. To qualify, taxpayers must:

- Have filed a 2023 New York State resident income tax return (Form IT-201);

- Have been a full-year resident of the state;

- Not have been claimed as a dependent;

- Fall within certain income brackets determined by filing status.

Payment Breakdown

| Filing Status | Adjusted Gross Income (AGI) | Payment Amount |

|---|---|---|

| Single | ≤ $75,000 | $200 |

| Single | $75,001–$150,000 | $150 |

| Married (Joint) | ≤ $150,000 | $400 |

| Married (Joint) | $150,001–$300,000 | $300 |

The New York Department of Taxation and Finance confirmed that approximately 8 million residents fall within these categories.

“The goal is to ensure that middle- and lower-income earners—those most affected by inflation—see timely, automatic relief,” said a department spokesperson.

How and When Payments Will Arrive

The first batch of payments was mailed on September 26, 2025, with additional rounds continuing through November.

- Direct deposit recipients will see funds appear in their bank accounts labeled “NY Inflation Refund.”

- Paper checks are being mailed to the addresses listed on 2023 tax filings.

- There is no application process or ZIP-code prioritization; the rollout is uniform across the state.

Residents are advised to confirm their mailing address or bank details with the state tax department if they recently moved or changed financial institutions.

“These are automatic payments—no forms, no calls, no portals,” said Danny Werfel, Commissioner of the Internal Revenue Service (IRS), clarifying that the program is state-run, not federal.

Why New York Is Sending Out These Checks

The relief checks are part of a wider effort by U.S. states to offset persistent inflation that continues to pressure household finances even as national rates moderate.

According to the U.S. Bureau of Labor Statistics (BLS), inflation averaged 3.1% in 2025, down from a 40-year high of 8.0% in 2022 but still above pre-pandemic norms. Rent and energy costs in New York City, for instance, remain 20–25% higher than five years ago.

“Inflation has cooled, but prices haven’t fallen,” said Dr. Erica York, senior economist at the Tax Foundation. “These state-level refunds serve as limited but meaningful relief for households facing enduring cost pressures.”

The program mirrors earlier one-time refund initiatives, such as the 2022 Middle-Class Tax Refund and the 2023 Home Energy Assistance Supplement.

Historical Context: State Stimulus and Fiscal Strategy

New York’s approach reflects a growing trend among states to deploy budget surpluses for direct consumer support. Similar actions have been taken by California, Minnesota, and Maine, each offering inflation-related rebates in 2023 and 2024.

Economists say such localized efforts allow flexibility and can target residents more effectively than federal aid.

“Federal stimulus checks were broad and fast but costly,” said Howard Gleckman, senior fellow at the Urban-Brookings Tax Policy Center. “State refunds, by contrast, are smaller, data-driven, and tailored to local fiscal realities.”

Still, critics warn that one-time payments are temporary fixes that do little to resolve structural affordability challenges.

“Housing, childcare, and insurance remain the primary drivers of economic stress,” said E.J. McMahon of the Empire Center for Public Policy. “Relief checks are politically appealing but don’t address long-term cost trends.”

Broader Fiscal Impact

According to the New York State Division of Budget, the program will cost roughly $2.9 billion—a figure comfortably absorbed within the state’s surplus. Officials emphasized that it will not require new borrowing or tax increases.

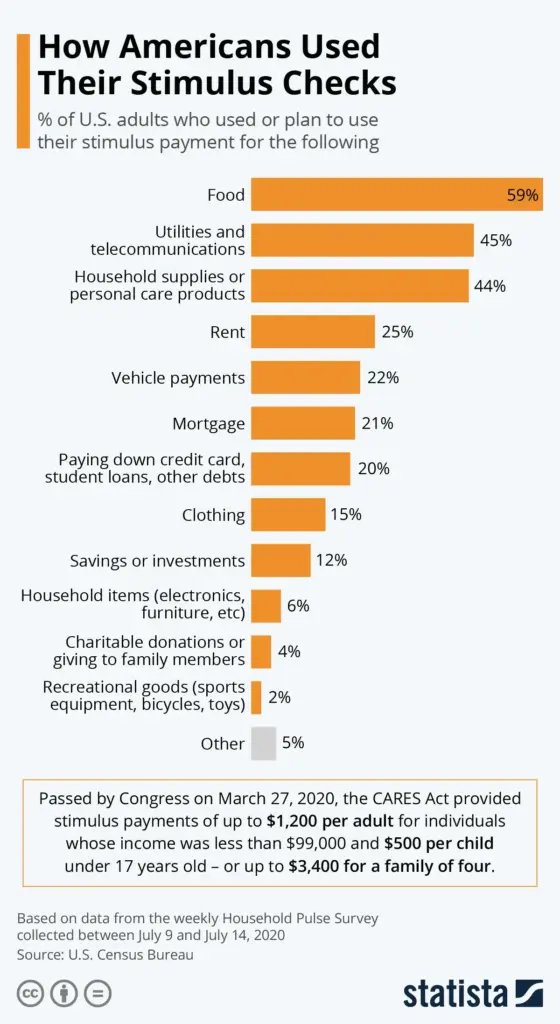

The refunds are expected to boost local spending modestly, particularly in retail and utilities. Economists note that the limited scale of the program makes it unlikely to meaningfully impact inflation.

“At this size, the checks are stimulative locally but neutral in macroeconomic terms,” said Dr. Mark Zandi, Chief Economist at Moody’s Analytics. “They act as a pressure valve rather than a policy lever.”

Public Reception and Fraud Warnings

Initial public response has been positive, though authorities are warning residents to be cautious about scams.

The New York Attorney General’s Office reported a rise in fraudulent texts and emails claiming to offer “faster processing” or “bonus” payments. Officials stressed that no government agency will request banking or personal details via phone or email.

“If it sounds too good to be true, it probably is,” said Attorney General Letitia James, urging residents to report suspicious messages through the state’s fraud hotline.

Related Links

IRS Unveils 2026 Tax Brackets — Here’s How Inflation Could Affect Your Take-Home Pay

SSA Beneficiaries in 10 States Set for Bigger Checks — Check Why and How Much You’ll Get

What’s Next

State budget analysts say future relief measures will depend on 2026 revenue forecasts and federal policy decisions. The New York Fiscal Year 2026 budget is expected to prioritize infrastructure, housing, and climate resilience, leaving limited room for new refunds.

“We view this as a one-off measure,” said Budget Director Blake Washington. “If inflation remains stable, our focus will shift toward long-term affordability reforms rather than direct payments.”

Residents who have not received their check by December 2025 should contact the New York Department of Taxation and Finance Refund Unit for assistance.

FAQ About $400 Stimulus Checks

Do I need to apply?

No. Payments are automatic based on your 2023 state tax filing.

When will payments finish?

The final batch is expected by late November 2025.

Are these taxable?

They are state refunds, not federal income, and generally not taxable at either level.

Will there be another round?

Not currently. Future payments will depend on 2026 state budget outcomes.