Social Security Payments Coming on Dec. 10 — Check If Your Check Is Included

Social Security payments are set to be distributed on December 10, 2025, as part of the regular monthly schedule. If you are a recipient, it’s crucial to confirm whether your check falls under this payment cycle.

This article outlines the payment dates for various beneficiaries and explains how you can verify your eligibility for the December 10 payment.

Social Security Payments Coming

| Key Fact | Detail/Statistic |

|---|---|

| Payment Date for Birthdays 1-10 | December 10, 2025 |

| Payment for Birthdays 11-20 | December 17, 2025 |

| Payment for Birthdays 21-31 | December 24, 2025 |

| Early SSI Payment | December 3, 2025 (for SSI recipients) |

| COLA Adjustment | 2.8% increase in January 2026 |

Social Security Payment Schedule — Who Gets Paid on Dec. 10?

Each month, the Social Security Administration (SSA) issues payments according to a strict schedule based on your birth date. This is crucial for recipients who rely on these payments for their livelihood.

If your birthday falls between the 1st and 10th of any month, your payment typically arrives on the second Wednesday of that month. For December 2025, that date is December 10. However, it’s important to verify that your check is indeed part of this cycle, especially if you are a new recipient or have encountered any issues with previous payments.

Understanding the timing and process can help you avoid confusion, particularly as the end-of-year holiday season approaches. Below, we break down how Social Security’s monthly disbursement works, with a focus on December’s payments, and why verifying your payment date is essential.

How Social Security Payments Work

Social Security payments are part of the benefits received by retirees, disabled individuals, and surviving family members of eligible workers. These payments are issued by the Social Security Administration, and the amount each recipient receives depends on their earnings history, the nature of their disability (if applicable), and the type of benefit they are entitled to.

The SSA disburses these payments on specific days based on your birth date. If you were born between the 1st and 10th, your payment typically arrives on the second Wednesday of each month. For December 2025, that means your Social Security payment is set to arrive on December 10.

Important Note: For those receiving Supplemental Security Income (SSI), payments are generally made earlier in the month, with the December 2025 payment arriving on December 1, due to a federal holiday later in the year.

Verifying Your Payment Schedule for December 2025

While the Social Security Administration follows a fixed schedule for monthly payments, there are several variables that may influence when you receive your payment:

- Eligibility Date: If you’ve recently applied for Social Security or have started receiving benefits in the past few months, you may not yet be familiar with the payment schedule.

- Birth Date: The payment dates vary based on your birth date, so it’s essential to verify that your birth date falls between the correct range for December’s distribution.

- Method of Payment: Direct deposit payments usually arrive a day or two earlier than paper checks. If you’ve opted for a prepaid card or direct deposit, it’s wise to check your bank or prepaid card account to confirm the deposit has been made.

- Holidays: Since the U.S. observes federal holidays, the payment schedule may shift. In December, for example, New Year’s Day (January 1) will lead to the early release of January’s Social Security payment on December 31, 2025 for many recipients.

SSI Recipients: Double Payment Alert

Some SSI recipients will receive two payments in December 2025. Due to the holiday schedule and the fact that January 1 is a federal holiday, January’s SSI check will be issued early. Therefore, SSI beneficiaries will receive:

- Their regular December payment on December 1.

- Their January payment on December 31, 2025.

This can be particularly helpful for those who rely on Social Security for their daily expenses, allowing recipients to plan their budgets and manage any potential gaps caused by the holidays.

COLA Increase — What’s New in 2025?

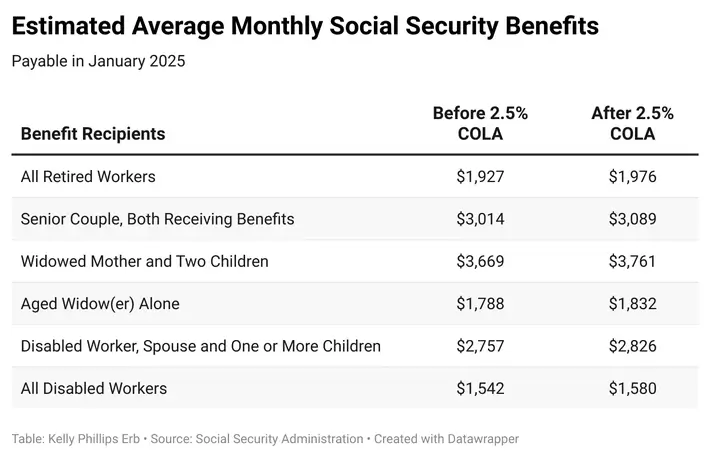

For 2025, Social Security recipients will benefit from a 2.8% Cost-of-Living Adjustment (COLA) increase. The COLA adjustment is designed to help recipients keep pace with inflation by increasing their benefits.

This increase will be reflected in January 2026 payments but is relevant to December’s payment for planning purposes. The typical retiree will see an average increase of approximately $56 per month due to the COLA adjustment, bringing the average monthly payment for retirees to $1,800 per month.

What to Do If Your Social Security Payments Is Delayed

While most recipients will receive their December 10 Social Security payments as scheduled, there are a few potential reasons why someone might encounter a delay:

- Banking Delays: If you receive your payment via direct deposit, it’s crucial to check your account to verify when the funds are transferred. Delays at the bank level could impact the timing.

- Missing Payment: If your payment has not arrived within a few business days of the expected release date, SSA advises recipients to contact their office to ensure that no issues are present with your account. Be sure to have your personal information and claim number handy to facilitate the process.

- Address Changes: If you’ve recently changed your address or banking information, it could cause a delay in receiving your payment. Make sure that any updates have been processed by the SSA to avoid issues.

History of Social Security Payments

The history of Social Security dates back to the 1930s, when President Franklin D. Roosevelt introduced the Social Security Act as part of the New Deal. Initially designed as a social safety net for retirees, the system has evolved to cover disabled workers, their families, and survivors.

Over the years, the SSA has streamlined payments to ensure timely distribution, introducing electronic payments in the 1990s to reduce costs and improve reliability. Since its inception, the system has expanded its reach and increased benefits to keep pace with inflation. Today, millions of Americans depend on Social Security to cover a significant portion of their income.

Potential Changes to the Social Security System

As Social Security remains a crucial part of American social policy, discussions about potential reforms are ongoing. In recent years, there has been increasing attention on the long-term solvency of the program, with some experts warning that the Trust Fund may face challenges in the coming decades.

Discussions about increasing the payroll tax, raising the retirement age, or changing the COLA calculation have gained traction in Washington.Though no immediate changes are expected for recipients in 2025, it is essential for beneficiaries to stay informed about proposed legislation and how it might affect their benefits in the future.

Impact of Social Security Payments on the Economy

Social Security payments have a significant impact on both local and national economies. These monthly disbursements inject billions of dollars into the U.S. economy, supporting consumer spending, especially in areas with high concentrations of retirees.

Local businesses, particularly in communities with large populations of Social Security recipients, see steady revenue from grocery stores, healthcare providers, and other essential services. The payments also play a vital role in reducing poverty, particularly among seniors. According to the AARP, Social Security lifted more than 15 million Americans out of poverty in 2022 alone.

State-Specific Information: Taxes on Social Security Benefits

While Social Security benefits are federally regulated, individual states may impose taxes on these benefits. As of 2025, 13 states tax Social Security income, including Colorado, Connecticut, and West Virginia.

However, some states, such as Florida, Texas, and Washington, do not tax Social Security benefits at all. It’s important for recipients to understand their state’s tax laws to accurately plan their finances.

Access SSA Resources

If you have questions or need assistance, the Social Security Administration provides multiple resources:

- Social Security Website: The SSA’s website (www.ssa.gov) offers detailed information on eligibility, benefit amounts, and the payment schedule.

- SSA Hotline: Call the SSA at 1-800-772-1213 for direct support and inquiries.

- My Social Security Account: Create a personal online account to view your payment history, estimate future benefits, and make changes to your account information.

Related Links

Social Security Update: New Full Retirement Age Announced for Future Beneficiaries

$2,000 Tariff Dividend: One Requirement Decides Eligibility — Trump Reveals the Expected Payout Date

As Social Security payments arrive on December 10, 2025, it is important for recipients to know whether they fall under this distribution date. Birth dates between 1st and 10th make those eligible for this particular cycle, while others will receive payments later in the month. Additionally, SSI recipients should be aware of the early December payments for the holidays.

With the 2.8% COLA increase coming in January, it’s also a good time for beneficiaries to plan ahead and make necessary adjustments to their finances. Stay informed by checking your payment dates, ensuring that your information is up to date, and being mindful of the holiday season’s impact on the schedule.

As always, if you believe your check is delayed or if you encounter issues, the Social Security Administration (SSA) provides resources and support to help resolve any concerns efficiently.