Smart Ways to Cut Taxes on a $1 Million Retirement RMD – Check Details

Retirees holding around $1 million in tax-deferred retirement accounts face substantial annual Required Minimum Distributions (RMDs) once they reach IRS-mandated age. These withdrawals are taxed as ordinary income, often pushing households into higher tax brackets.

This article explains the Cut Taxes on a $1 Million Retirement RMD, the risks large RMDs pose for retirement planning, and the smartest, IRS-approved strategies to reduce the tax burden.

Smart Ways to Cut Taxes on a $1 Million Retirement RMD

| Key Fact | Detail |

|---|---|

| RMD Age | Begins at age 73 under SECURE 2.0 Act |

| Typical RMD for $1M Account | Around $40,000–$50,000 annually |

| RMD Tax Type | Taxed as ordinary income |

| Strategies to Lower Tax | Roth conversions, QCDs, early withdrawals, timing |

Understanding Your RMD Obligations

The IRS requires retirees to begin taking RMDs from traditional IRAs, 401(k)s, 403(b)s, and similar tax-deferred accounts beginning at age 73. For retirees with approximately $1 million in savings, the initial RMD often surpasses $40,000, with required withdrawals increasing each year.

RMDs exist because the government granted tax-deferred growth for decades. Eventually, the IRS must collect taxes on that money, and the RMD ensures revenue flows back to the federal system. The challenge is that RMDs are taxed as ordinary income, which may:

- Increase federal income taxes

- Trigger Social Security benefit taxes

- Raise Medicare Part B and D premiums

- Push retirees into higher marginal tax brackets

Cut Taxes on a $1 Million Retirement RMD: Smart Ways to Cut Taxes on a $1 Million Retirement RMD

The Cut Taxes on a $1 Million Retirement RMD becomes especially important when account balances exceed seven figures. Without careful planning, retirees may pay more taxes than necessary, reduce lifetime wealth, and expose heirs to larger future tax burdens.

The good news: IRS rules allow several effective, legal strategies to reduce RMD taxes, shift taxable income, or avoid RMDs entirely through long-term planning.

Overview Table: How Major Strategies Reduce RMD Tax

| Strategy | How It Helps | Best For |

|---|---|---|

| Early withdrawals (59½–73) | Reduces future RMD size | Retirees in low-income years |

| Roth conversions | Eliminates future RMDs | Long-term planners |

| QCD (Charity) | Counts toward RMD but not taxed | Charitably inclined taxpayers |

| Timing RMDs | Reduces bracket jumps | High-income retirees |

| Reinvest RMDs | Maintains long-term growth | Those not needing the income |

| Annuities | Spreads tax impact | Retirees wanting income stability |

Major Strategies to Reduce RMD Taxes

1. Begin Early Withdrawals Before RMD Age

Withdrawals from traditional IRAs or 401(k)s between age 59½ and 73 are penalty-free. By taking controlled withdrawals before RMD age:

- You gradually reduce the account balance

- The ultimate RMD amount becomes smaller

- You may keep taxable income within a lower bracket

Retirees in the years between full-time employment and Social Security benefits—often called the “tax planning window”—benefit the most.

2. Roth IRA Conversions: Pay Taxes Now, Save Later

Converting traditional IRA funds into a Roth IRA is one of the most powerful ways to lower future RMDs.

Benefits of Roth conversion:

- Roth IRAs do not have RMDs during your lifetime

- All future growth occurs tax-free

- Withdrawals are tax-free in retirement

- Reduces future taxable estate for heirs

Large conversions should be planned carefully—spread over multiple years if needed—to avoid pushing income into higher tax brackets.

3. Use Qualified Charitable Distributions (QCDs)

For retirees age 70½ or older, QCDs allow up to $100,000 to be donated from an IRA directly to a qualified charity.

QCD Benefits:

- Counts toward your RMD

- Not included in taxable income

- Reduces AGI, which can lower Medicare premiums

- Helps avoid taxation on Social Security benefits

For charitably inclined retirees, this strategy is one of the most tax-efficient available.

4. Time Your RMD to Avoid Tax Bracket Jumps

RMDs must be taken by December 31 each year (except your first RMD year, which can extend to April 1). Strategic timing allows retirees to:

- Align RMDs with lower-income periods

- Avoid taking large withdrawals early in the year if financial markets are rising

- Prevent stacking multiple taxable events in the same year (e.g., capital gains, property sales, Roth conversions)

5. Reinvest RMDs Into Tax-Efficient Accounts

If you don’t need RMD income for living expenses, reinvesting can help maintain long-term wealth.

Common reinvestment options:

- Taxable brokerage account

- Municipal bond funds (tax-advantaged)

- 529 education plans for grandchildren

- Indexed ETFs with low turnover

Although the RMD itself is taxable, reinvestment preserves the potential for continued portfolio growth.

6. Consider Annuities for Income Smoothing

Certain annuities can help reduce taxable income volatility.

Options include:

- Qualified Longevity Annuity Contracts (QLACs) — allow you to defer part of your RMD

- Fixed or variable annuities — provide predictable income streams

Annuities are not ideal for everyone, but they offer tax-planning advantages for retirees wanting reduced market exposure.

Deeper IRS Rules Retirees Need to Know

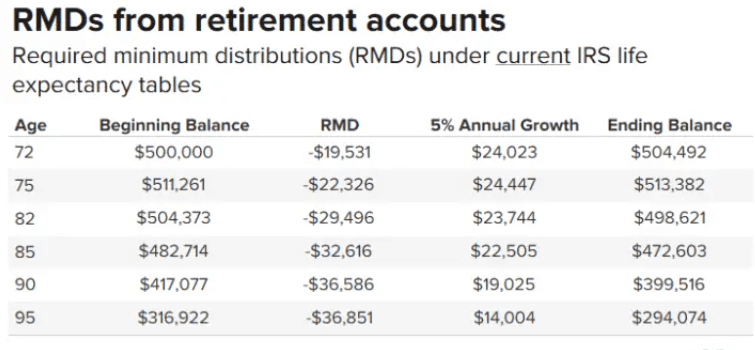

How RMDs Are Calculated

The IRS Uniform Lifetime Table determines RMD amounts by dividing your account value by a “life expectancy factor.” Because the factor decreases each year, RMDs increase as retirees age.

Example:

- Balance: $1,000,000

- Divisor at age 73: 26.5

- First RMD: ~$37,735

Over time, RMDs can exceed $60,000–$80,000 annually if investments grow.

How RMDs Affect Social Security

Up to 85% of Social Security benefits may become taxable if RMDs push your income above IRS thresholds. Reducing RMD size through early withdrawals or Roth conversions helps preserve Social Security income.

How RMDs Affect Medicare

Large RMDs can push income above IRMAA thresholds, increasing Medicare Part B and D premiums. Tax-efficient planning can avoid hundreds to thousands of dollars annually in added Medicare costs.

Additional Strategies for High-Net-Worth Retirees

1. Use Tax-Loss Harvesting

If you have a taxable investment account, selling underperforming assets to offset taxable RMD income can reduce your overall tax liability.

2. Coordinated Spousal Strategies

Married couples can:

- Convert to Roth in lower-income spouse’s name

- Use separate IRAs to diversify timing

- Manage tax brackets at the household level

3. Delay Social Security to Age 70

This maximizes monthly benefits and gives you more “low-income” years to perform Roth conversions before RMDs begin.

4. Multi-Year Tax Projection

Financial planners use multi-year simulations to determine precisely:

- Ideal withdrawal amounts

- Optimal conversion windows

- How to minimize lifetime tax burden

Potential Risks and Mistakes to Avoid

- Converting too much at once may trigger unwanted tax brackets

- Missing the RMD deadline leads to a 25% IRS penalty (reduced from 50%)

- Taking QCDs incorrectly (e.g., funds flowing through your bank account) nullifies their tax benefits

- Failure to coordinate multiple retirement accounts can result in over- or under-withdrawal

Related Links

IRS Announces Major Updates for 2026 — What Taxpayers Should Start Preparing for Now

2026 Social Security Increase Set — But Will Higher Medicare Part B Costs Reduce Your Raise?

Expert Opinions & National Trends

Financial planners increasingly recommend:

- Beginning RMD reduction strategies 10 years early

- Making Roth conversions part of retirement planning, not an occasional tactic

- Using QCDs annually, not sporadically

The SECURE 2.0 Act’s changes to RMD rules (raising the start age) may help retirees, but many experts warn this could lead to larger RMDs later, making planning even more essential.

Suggested image: A high-quality photo of a retiree working with financial documents and a calculator. Include appropriate photo credit.

RMDs are unavoidable for millions of retirees, but excessive taxes don’t have to be. With careful planning—spanning Roth conversions, charitable giving, early distributions, and strategic timing—retirees can significantly reduce their tax burden and preserve long-term wealth. As IRS rules evolve, early planning remains the most effective defense against rising RMD-related taxes.

FAQs About Retirement RMD

1. Does a Roth IRA have RMDs?

No. Roth IRAs do not require RMDs during the owner’s lifetime.

2. Can you avoid RMDs entirely?

Only by shifting assets into accounts not subject to RMDs—mainly Roth IRAs.

3. Are QCDs available for 401(k)s?

No. QCDs must come from IRAs.

4. Should you hire a tax planner?

For retirees with $1 million or more in tax-deferred savings, advisors often save far more in taxes than they cost.