Final November Social Security Payments Arrive This Week — Who Gets the Last Round

The Social Security Administration (SSA) will issue the final round of November payments on Wednesday, November 26, 2025, completing the monthly disbursement cycle for more than 70 million Americans.

The payment, which goes to beneficiaries whose birthdays fall between the 21st and 31st of any month, arrives as families prepare for the holiday season and look ahead to the 2026 cost-of-living adjustment.

Final November Social Security Payments

| Key Fact | Detail |

|---|---|

| Final November payment date | Nov. 26, 2025 |

| Who receives this wave | Birthdays 21st–31st |

| Number of beneficiaries | 70 million+ |

| Next COLA increase | 2.8% effective Jan 2026 |

What the Final November Payment Means

What Are the Final November Social Security Payments?

The final November Social Security payments refer to the last scheduled distribution of monthly benefits, which the SSA delivers on the fourth Wednesday of the month. This wave goes to retirees, disabled workers, and survivors whose benefit record aligns with the 21st–31st birthday group.

Why this group gets paid last

The SSA pays standard Social Security benefits in three waves each month, using the primary wage earner’s birth date as the determining factor. This approach, implemented in 1997, spreads out payments to avoid system overload and ensure stable bank-processing operations.

Who Gets Paid on November 26

Standard Recipients

The final payment wave includes anyone who:

- Receives retirement, disability, or survivor benefits;

- Filed after May 1997; and

- Has a birthday between the 21st and 31st.

This is the largest of the three recipient groups, which is why the late-month payment often attracts heightened public attention.

Early Filers and Dual Beneficiaries

Some recipients do not follow the Wednesday schedule:

1. Beneficiaries receiving Social Security before May 1997

These individuals receive their payments on the third day of each month. Their November 2025 payment was deposited on Monday, November 3.

2. Supplemental Security Income (SSI) recipients

SSI payments are issued on the first of each month, but early if that date falls on a weekend or federal holiday.

- For November 2025, the SSI payment was sent Friday, October 31, because November 1 fell on a Saturday.

3. Dual Social Security + SSI beneficiaries

These individuals receive:

- SSI on October 31 (for November), and

- Social Security on November 3.

Why the Payment Matters Now

1. Arrival just before the holiday period

For millions of retirees living on fixed incomes, the timing of the late-November deposit helps ease the financial burden of rising seasonal expenses. According to the Pew Research Center, nearly one in three Social Security recipients uses their monthly benefit to cover all essential household costs.

2. Pre-COLA context

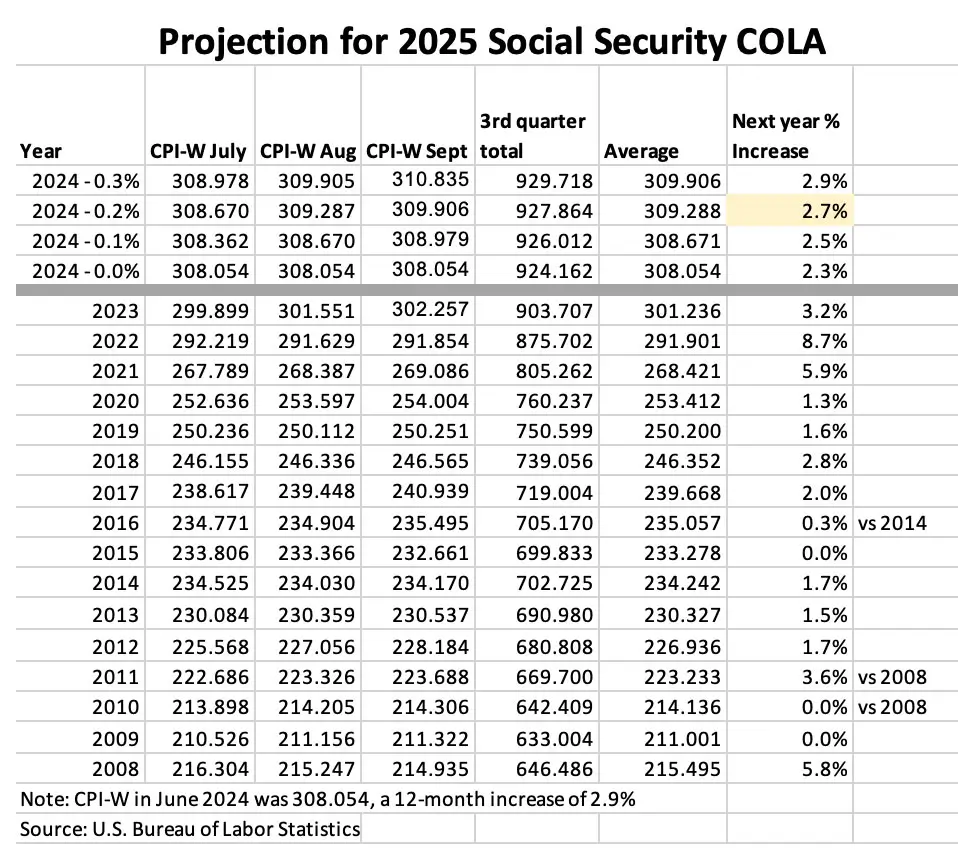

The November 26 payment is the second-to-last benefit issued before the 2.8% COLA increase takes effect in January 2026.

- The average retiree benefit is $2,008.

- A 2.8% increase adds roughly $56 a month.

3. Payments proceed despite government shutdown

Although the federal government entered a shutdown in October 2025, Social Security payments continue uninterrupted. By law, the program is classified as mandatory spending, meaning benefits must go out even when other services pause.

How the Final November Social Security Payments System Works

Understanding the SSA’s Three-Wave Distribution Model

Social Security uses a staggered system to better manage treasury outflows and electronic deposits.

Wave 1 – Second Wednesday

Birthdays: 1st to 10th

Wave 2 – Third Wednesday

Birthdays: 11th to 20th

Wave 3 – Fourth Wednesday

Birthdays: 21st to 31st

This wave—the focus of this article—is the final November group.

Supplemental Security Income (SSI) Timing

SSI follows a separate rule because the program serves low-income elderly and disabled individuals with fewer financial buffers. Payments always go out on the first of the month, unless that day is a weekend or holiday.

Direct Deposit Only

Paper checks were eliminated in 2013. All beneficiaries must use:

- Direct deposit, or

- Direct Express prepaid card.

The Treasury Department reports that electronic payments reduce fraud, delivery delays, and administrative costs.

Expert Commentary and Additional Context

Economic Perspective

Dr. Melissa Grant, a senior policy analyst at the Center on Budget and Policy Priorities, notes that the final monthly payment often plays an outsized role in household budgeting:

“For recipients in the late-month group, the November payment arrives at a critical time, especially amid inflation pressures and increased holiday spending.”

Demographic Impact

According to SSA actuaries, more than 50% of retirees rely on Social Security for at least half of their income. Among retirees aged 75 and older, that figure rises sharply. This makes predictable payment schedules essential for maintaining basic financial stability.

Historical Note

The shift to Wednesday-based payments began in 1997. Until then, all payments went out on the third of the month, creating national banking delays and administrative bottlenecks.

Fraud Prevention and Beneficiary Security

Rising scams targeting seniors

According to the Federal Trade Commission (FTC), Social Security impostor schemes remain one of the most common fraud types aimed at older Americans.

Tips from SSA:

- SSA will never call to threaten your benefits.

- Do not share Social Security numbers or banking information by phone.

- Report suspicious activity to oig.ssa.gov.

Account security

Beneficiaries should ensure their mySocialSecurity account details are updated before November 26 to prevent deposit issues.

Preparing for December and the New Year

What recipients should do

- Review bank information on file.

- Monitor deposit history around major holidays.

- Plan for the January COLA increase.

- Contact SSA only after three business days if a deposit is missing.

Related Links

Trump’s Sudden Reversal on Disability Cuts: Why the SSA Plan Was Pulled and What Happens Now

Filing Too Early Could Reduce Your Social Security by $1,080 Monthly — Government Update

Looking ahead

As 2026 approaches, analysts expect the COLA increase to provide modest but meaningful relief for retirees coping with higher living costs. While the adjustment cannot fully offset inflation, it reinforces Social Security’s role as a stabilizing force for older and disabled Americans.

With the final November Social Security payments arriving this week, beneficiaries can expect stable distribution despite broader government challenges. As the year ends and the 2026 COLA approaches, millions of households will see modest income growth that may help ease financial pressures in the months ahead.

FAQ About Final November Social Security Payments

Q: Why is my payment on the 26th instead of earlier?

Because your birthday falls between the 21st and 31st.

Q: Does this payment include the 2026 COLA?

No. COLA increases begin with the January 2026 payment.

Q: What if I changed banks recently?

Update SSA records immediately. Incorrect account information can delay payment.

Q: Why are SSI payments separate?

SSI operates under different eligibility rules and follows a different schedule.