New Mortgage Costs After the Fed’s October Rate Cut: What Buyers Will Pay Monthly

The Federal Reserve’s October decision to reduce its benchmark interest rate is beginning to ease borrowing costs across the U.S. housing market, with average mortgage rates drifting into the mid-6 percent range.

While monthly payments for new buyers have declined from the peaks seen earlier this year, mortgage costs remain elevated compared with pre-pandemic norms, prompting caution among analysts and policymakers.

New Mortgage Costs

| Key Fact | Detail / Statistic |

|---|---|

| Fed rate cut | Federal funds rate lowered to 3.75%–4.00% in October 2025 |

| Average mortgage rate | ~6.26% for 30-year fixed nationwide |

| 600k mortgage example | ~$3,597/month at 6.0% (principal + interest) |

| Forecast | Mortgage rates expected to remain above 6% through 2026 |

What the Fed’s October Rate Cut Means for U.S. Borrowers

The October 2025 rate cut was the second reduction in as many months, signaling a shift toward easing financial conditions after more than two years of elevated rates. The Federal Open Market Committee (FOMC) cited “somewhat elevated” inflation and cooling labor conditions as reasons for easing policy.

Fed Chair Jerome Powell emphasized that future cuts would depend on the direction of inflation and employment data.

Economists note that the benchmark rate directly affects short-term borrowing such as credit cards and auto loans, while mortgages respond more to long-term bond yields. Still, rate cuts can increase investor confidence and reduce Treasury yields, which in turn may bring mortgage rates lower.

“The Fed has opened a narrow window for housing relief,” said Dr. Lisa Hall, a senior economist at the University of Michigan. “But elevated Treasury yields and tight housing supply will limit how far mortgage rates can fall in the short term.”

How Mortgage Rates Are Responding

Current Mortgage Rates

As of late October 2025:

- 30-year fixed: ~6.2%

- 15-year fixed: ~5.5%

- 5/1 ARM: ~6.0–6.3%

This marks a notable improvement from January 2025, when 30-year rates hovered above 7.0%, driving monthly payments close to their highest level in two decades.

Sample Monthly Payments

600,000 mortgage (30-year fixed)

- At 6.00% → approx. $3,597/month

- At 7.00% → approx. $3,992/month

800,000 mortgage (30-year fixed)

- At 6.22% → approx. $4,910/month

650,000 mortgage (15-year fixed)

- At 5.50% → approx. $5,311/month

These estimates exclude property taxes, homeowners insurance, HOA dues, and PMI—each of which varies by region.

Why Mortgage Rates Are Not Falling Faster

Treasury Yields Remain Elevated

Mortgage rates track the 10-year Treasury yield more closely than the federal funds rate. Yields have remained stubbornly high due to strong government borrowing, global geopolitical risks, and investor caution.

Inflation Pressures Persist

Although inflation has cooled from its 2022 peak, it remains above the Federal Reserve’s 2% goal. Sticky shelter and service costs continue to influence mortgage pricing.

Lender Risk Premiums

Lenders build additional risk margins into mortgage rates to protect against loan defaults and market volatility. As economic uncertainty remains high, risk premiums have not softened significantly.

“Even with Fed cuts, lenders are uncomfortable reducing mortgage pricing too quickly,” explained David McKinney, a mortgage strategist at Moody’s Analytics. “Credit risk, inflation, and liquidity concerns are still driving decisions.”

The Housing Market Context

Limited Supply Keeping Prices High

The U.S. housing market continues to face a shortage of 3–4 million homes, according to estimates by the National Association of Realtors (NAR). This shortage keeps prices high even when demand softens.

Slower Sales Activity

Home sales fell earlier in 2025 as high borrowing costs sidelined many buyers. The recent rate cuts have revived interest, but activity remains below pre-pandemic norms.

Regional Differences

Affordability varies significantly:

- High-cost states like California, Washington, and New York still face monthly payments above national averages.

- Midwestern and Southern states, including Ohio, Alabama, and Tennessee, offer smaller loan sizes and lower insurance premiums, creating more manageable payments.

Refinancing Opportunities and Risks

Who Should Consider Refinancing?

Homeowners who locked in mortgage rates above 7% earlier in 2025 may benefit from refinancing—if they plan to keep their home long enough to offset closing costs. A refinancing from 7.1% to 6.2% on a $500,000 loan could save over $300/month.

Risks to Consider

- Closing costs typically equal 2–5% of the loan amount.

- Refinancing resets the loan term, extending repayment for some borrowers.

- Those planning to move in the next 3–5 years may not recoup the upfront costs.

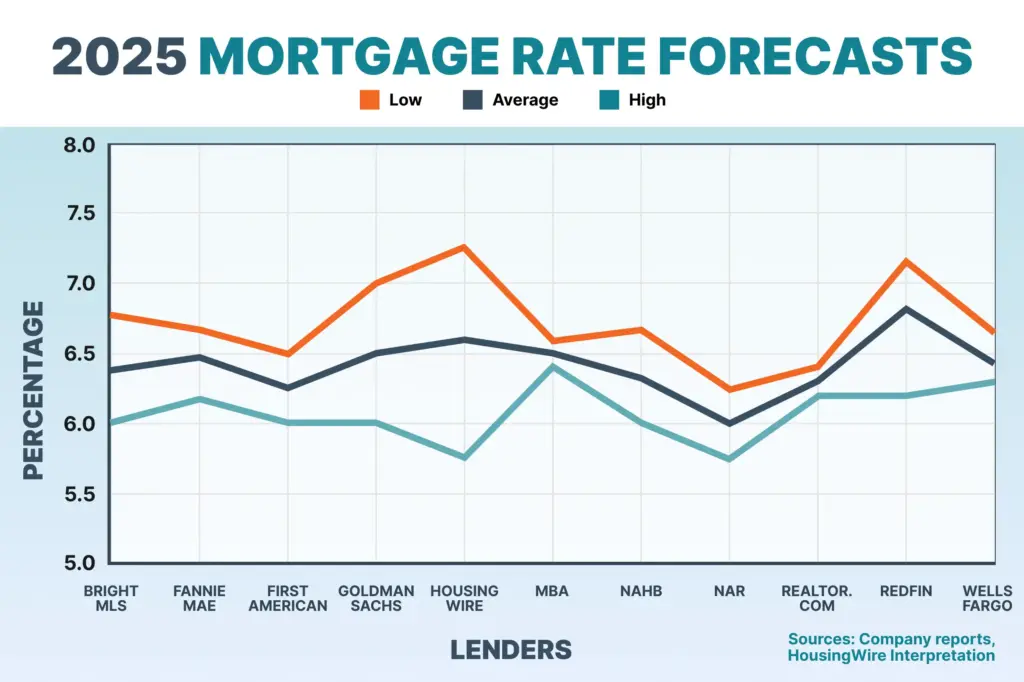

Expert Forecasts: What Comes Next

Most economists expect mortgage rates to remain in the 6–6.5% range well into 2026.

The Mortgage Bankers Association (MBA) projects that rate declines will be slow, gradual, and uneven.

“Mortgage rates can fall only when inflation moves convincingly downward,” said Janet Ruiz, a policy analyst at the Brookings Institution. “The October cut is a start, but not a turning point.”

Analysts caution buyers to avoid waiting indefinitely for lower rates. If inflation rises, the Fed may pause further cuts or even consider tightening again.

Related Links

Walmart Settlement Update — Shoppers Could Be Eligible for Part of a $5.6 Million Payout

New York Expands Its Tourism Push — State Joins Major Cities to Showcase Itself at IMEX America 2025

While the Federal Reserve’s October rate cut has offered some relief to homebuyers, analysts emphasize that mortgage rates will remain above historical lows for some time. With economic conditions shifting and inflation pressures lingering, borrowers face an environment of modest improvement rather than dramatic change.

FAQs About New Mortgage Costs

Is now a good time to buy a home?

Affordability has improved since early 2025, but high home prices still pose challenges. Buyers with stable incomes may find more favorable conditions now than earlier this year.

Will mortgage rates fall below 5% again?

Experts say this is unlikely in the near future unless the economy enters a significant slowdown.

Are ARMs (Adjustable-Rate Mortgages) safer now?

ARMs carry more risk when long-term rate direction is uncertain. Fixed-rate mortgages provide more stability in today’s environment.

Should I lock my rate now?

Borrowers expecting to close within 60 days may want to lock, as rate volatility remains high.