Final Day to Claim Up to $5000 From HCA Healthcare Data Breach Settlement — Check Eligibility Criteria

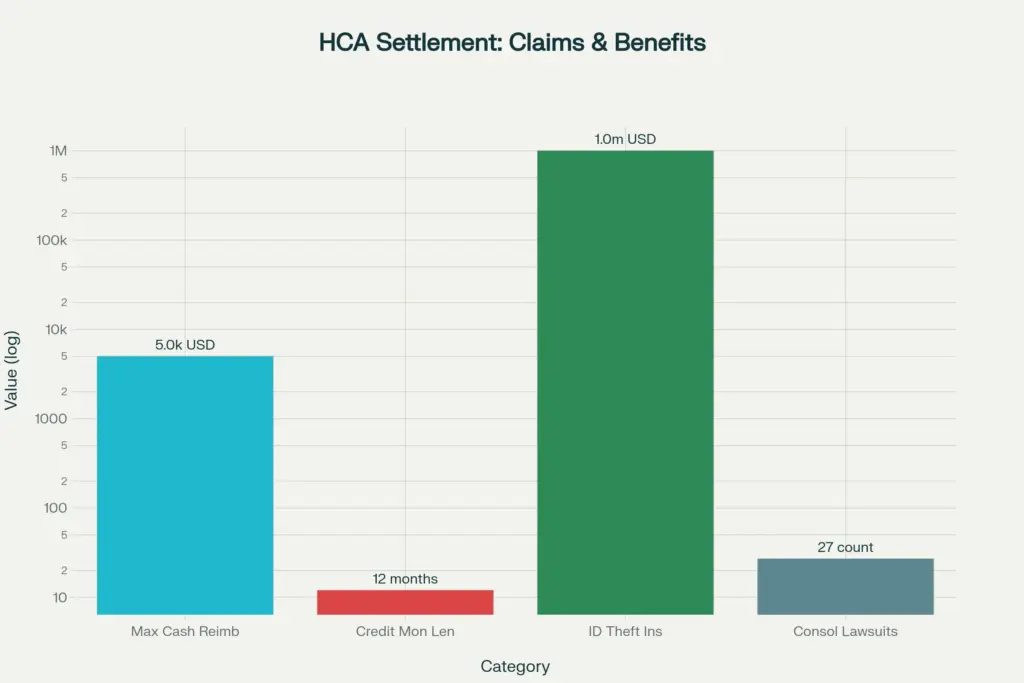

If you’ve been waiting to file your HCA Healthcare data breach settlement claim, this is the final call to act before you lose your chance at compensation and free identity protection. Eligible patients can claim up to $5000 for documented, unreimbursed losses tied to the July 2023 incident, along with a year of credit monitoring and identity theft support. The window is closing, and once the deadline passes, you generally forfeit these benefits. Don’t wait validate your eligibility and submit a complete claim with proof of loss if you experienced measurable costs after the breach.

HCA Healthcare data breach settlement claim. Yes, that’s the focus today and it matters because many impacted patients don’t realize they qualify or they underestimate what counts as reimbursable loss. The HCA Healthcare data breach settlement claim allows affected patients to seek cash reimbursement for tangible expenses like bank fees, fraud remediation costs, postage and notary charges, and identity recovery services, if they can show those losses were fairly traceable to the breach. On top of that, every eligible claimant can opt for a year of credit monitoring, restoration help, and identity theft insurance. If you received notice or used HCA facilities in the period covered by the incident, take a few minutes to check your status and file.

$5000 From HCA Healthcare Data Breach Settlement

| Item | Details |

|---|---|

| Claim Deadline | File online or mail your form postmarked by the published cutoff date. Late claims are typically denied. |

| Final Approval Status | The settlement has secured court approval, enabling claims administration and benefit distribution to proceed. |

| Who’s Eligible | U.S. patients whose personal information was impacted in the July 2023 incident announced by HCA. |

| Cash Benefit | Up to $5000 for documented, unreimbursed losses fairly traceable to the breach. |

| Monitoring Benefit | One year of credit monitoring, fraud consultation, identity restoration, and identity theft insurance. |

| Opt-Out/Objection | The window to opt out or object is closed; remaining class members should file claims before the deadline. |

| Data Involved | Names, contact details, dates of birth, and appointment details; not clinical or payment data per disclosures. |

| Case Notes | Dozens of lawsuits were consolidated; HCA denies wrongdoing but agreed to settle and implement security measures. |

If your data was part of the HCA incident, submit your claim today. The HCA Healthcare data breach settlement claim isn’t automatic you must file to receive reimbursement or monitoring. Gather your documentation, complete the form carefully, and keep your confirmation. Even if you don’t claim cash, the monitoring and restoration coverage are valuable protections against long-tail identity risks that can surface months down the line.

What Happened in The Breach

In mid-2023, attackers accessed an external storage system used to automate email formatting tied to patient communications. That repository contained non-clinical patient information such as names, contact details, birth dates, and appointment-related metadata. While there was no disclosure of clinical records or payment card data as part of the leaked set, the exposure still created real downstream risks: targeted phishing, account takeovers using personal identifiers, and administrative headaches for patients trying to secure their digital footprint. The litigation that followed consolidated multiple suits into a single case and ultimately produced a settlement that balances documented-loss reimbursement with preventative monitoring and restoration services.

Who Is Eligible for $5000 From HCA Healthcare Data Breach Settlement

Eligibility is defined around patients in the United States whose personal information was part of the incident HCA announced around July 2023. If you received a direct notice, that’s a strong indicator you’re in the class. If you didn’t receive a notice but think you were treated at an HCA facility or affiliated practice during the relevant period, you can still check the official settlement site for guidance to confirm your status. The class definition is broad, but benefits require action: to receive cash reimbursement or free monitoring, you must submit a valid claim by the deadline.

What You Can Claim and How It Works

There are two main benefits: reimbursement for documented losses and complimentary monitoring/restoration. For cash, you can request up to $5000, but you need proof that your costs were unreimbursed and reasonably tied to this incident. Examples include:

- Bank fees or card replacement costs resulting from fraud investigations.

- Postage, notary, or administrative fees to lock or unfreeze credit, update accounts, or dispute charges.

- Time-sensitive professional services tied to identity recovery and remediation.

- Other reasonable out-of-pocket expenses flowing from identity misuse linked to the breach.

For monitoring, eligible claimants receive a year of credit monitoring with fraud consultation, active restoration help if your identity is misused, and an identity theft insurance policy. Even if you don’t have documented losses, enrolling in monitoring is a smart hedge against delayed fraud exposure, which can occur months after a dataset circulates.

Key Deadlines You Must Meet

The claims deadline is firm: submit online by the cutoff or mail your form postmarked by the same date. If you miss it, you’ll typically be bound by the settlement’s release without receiving benefits. If you had intended to opt out or object, those windows have already closed. With final approval granted, the administrator can validate claims and disburse benefits after standard processing steps and any remaining procedural requirements conclude.

How To File Your Claim for $5000 From HCA Healthcare Data Breach Settlement

- Locate your notice: If you received a mailed or emailed notice, use your class member ID to speed up your claim.

- Gather documentation: Bank statements showing fees, letters confirming fraud, receipts for postage or notary, invoices for professional services, and communications that link actions you took to the breach.

- File online: Complete the claim form carefully, upload documents, and save your confirmation. If mailing, print clearly, include copies (not originals), and keep your proof of mailing.

- Choose your benefits: Select credit monitoring and, if applicable, request reimbursement with the amount and documents to substantiate your claim.

- Track status: Keep your submission confirmation and check for updates on payment timing after the administration process advances.

What Documentation To Provide For Reimbursement

The stronger your documentation, the smoother your path to approval. Aim for a clear paper trail that answers three questions: what you spent, when you spent it, and why it’s tied to this incident. Useful items include:

- Bank or card statements showing relevant fees or fraudulent activity and subsequent remediation steps.

- Written confirmations from banks or credit bureaus related to freezes, fraud alerts, or investigations.

- Receipts for postage, notary, phone charges, or secure mail used to handle identity protection steps.

- Invoices for identity protection or restoration services you paid out-of-pocket because of the breach.

- A simple timeline that connects the breach announcement to your actions and expenses.

Security Commitments and Why They Matter

Beyond cash and monitoring, the settlement includes a requirement for HCA to adopt and maintain specific security commitments for a defined period following the settlement. While those measures are filed under seal, such commitments typically involve governance, access controls, logging, vendor oversight, and incident response improvements. For patients, this matters because it raises the standard of care for the systems that touch personal data even if those systems don’t store clinical records. It also reflects a broader trend: courts and parties are using settlements not just to compensate, but to mandate architecture and process changes that reduce the risk of a repeat incident.

Scope Of Impact and Practical Risk

The incident affected a large patient population across multiple states, underscoring how non-clinical systems can still expose individuals to identity-related threats. Even without Social Security numbers in the compromised dataset, organized actors can triangulate leaked names, contact info, and appointment details with other public or illicit sources to craft convincing phishing campaigns. That’s why monitoring and restoration services are meaningful: they help you catch anomalies early, lock down credit files, and get hands-on support if suspicious activity surfaces.

What Happens If You Do Nothing

If you don’t file, you generally won’t receive any benefits no cash reimbursement and no free monitoring. You may still be covered by the settlement’s release, which means you give up the right to sue separately over the same issues. If you’re unsure whether you qualify for cash, at least enroll for the no-cost monitoring benefit; it’s a safety net that costs you only a few minutes and could save hours of remediation later.

Tips To Maximize Your Claim

- Be timely: Submit as early as possible to avoid rushed errors.

- Be precise: Numbers in your form should match your documentation.

- Be relevant: Only include expenses that can be reasonably connected to the breach.

- Be complete: Inadequate documentation is the most common reason claims are reduced or denied.

- Be organized: A brief cover note that lists documents and explains the sequence can help reviewers follow your logic.

Common Mistakes to Avoid

- Submitting photos of screens that are blurry or cropped so details aren’t visible.

- Claiming reimbursed losses or general time spent without proof of out-of-pocket costs.

- Missing the postmark date if mailing.

- Uploading password-protected files the administrator can’t open.

- Forgetting to actually elect the monitoring benefit when you qualify for it.

Triple Payment Boost – New Yorkers May Receive Up to $5,108 Before Thanksgiving

Payment Timing And What To Expect

Distributions start only after the claim’s administrator completes validation, applies the settlement terms, and wraps up required post-approval steps. If you filed for monitoring, activation instructions typically arrive before cash distributions conclude. If you requested reimbursement, expect requests for clarifications if something is unclear. Respond quickly and completely to avoid delays.

This section is your quick refresher on the HCA Healthcare data breach settlement claim. If you found out late or hesitated, you still have a narrow window to protect your interests. Take five minutes, pull your most relevant documents, and complete the online form. If you don’t have losses to claim, enroll in the monitoring anyway. Identity risk often shows up later, and the restoration support alone is worth the few minutes it takes to opt in.

FAQs on $5000 From HCA Healthcare Data Breach Settlement

Who is eligible to file a claim?

U.S. patients whose personal information was impacted in the July 2023 data incident announced by HCA. If you received a notice, you’re very likely in the class. If you didn’t, you can still review the official site’s eligibility guidance and proceed if you meet the criteria.

How much can I claim?

Up to $5000 in documented, unreimbursed out-of-pocket losses that are fairly traceable to the incident. You’ll need receipts, statements, or other proof that tie your expenses to actions you took because of the breach.

What counts as a reimbursable loss?

Examples include bank or card fees incurred while addressing fraud, costs for postage and notary services during remediation, paid identity protection or restoration services, and similar expenses directly linked to the incident.

What if I don’t have losses should I still file?

Yes. Elect the credit monitoring and identity theft restoration benefit. It’s free for eligible class members and provides meaningful protection and support.