New York has begun distributing $400 Inflation Refund Checks to more than eight million households, according to state officials, marking one of the largest direct taxpayer relief efforts in over a decade. The payments, launched as New York begins implementing a measure in the 2025–26 state budget, are designed to offset rising costs and help residents see if yours is on the way as mailings continue throughout the fall.

$400 Inflation Refund Checks

| Key Fact | Details |

|---|---|

| Payment Amount | Up to $400 per household |

| Eligible Households | Over 8.2 million |

| Application Needed? | No — automatic mailing |

| Legislative Basis | 2025–26 State Budget |

| Purpose | Offset inflation-driven tax burdens |

Understanding the $400 Inflation Refund Checks Program

New York’s decision to issue statewide Inflation Refund Checks follows months of debate over how to use stronger-than-expected tax revenues. According to the New York State Department of Taxation and Finance, taxpayers do not need to apply for the benefit. Checks are sent automatically based on information from 2023 income tax returns, including filing status, income, and mailing address.

Governor Kathy Hochul said the state aimed to “provide meaningful support to families still feeling the effects of inflation.” She noted that although inflation has gradually moderated, essentials such as housing, energy, and groceries remain expensive for millions of residents.

The refund is intended to help taxpayers recover some of the increased sales-tax revenue generated during the inflation surge that followed the pandemic’s economic disruption.

$400 Inflation Refund Checks Eligibility Rules and Payment Amounts

Income Thresholds

The refund amount is based on:

- Filing status

- 2023 New York Adjusted Gross Income (NYAGI)

- Eligibility under the state’s resident tax requirements

Maximum payment levels:

- $400 for married joint filers earning up to $150,000

- $300 for married joint filers earning $150,001–$300,000

- $200 for single, head-of-household, or married-separate filers earning up to $75,000

- $150 for filers earning $75,001–$150,000

Eligibility Scenarios

- A couple earning $145,000 → $400 check

- A single person earning $82,000 → $150 check

- A household filing jointly at $220,000 → $300 check

New York clarified that non-resident returns and partial-year returns do not qualify for the program.

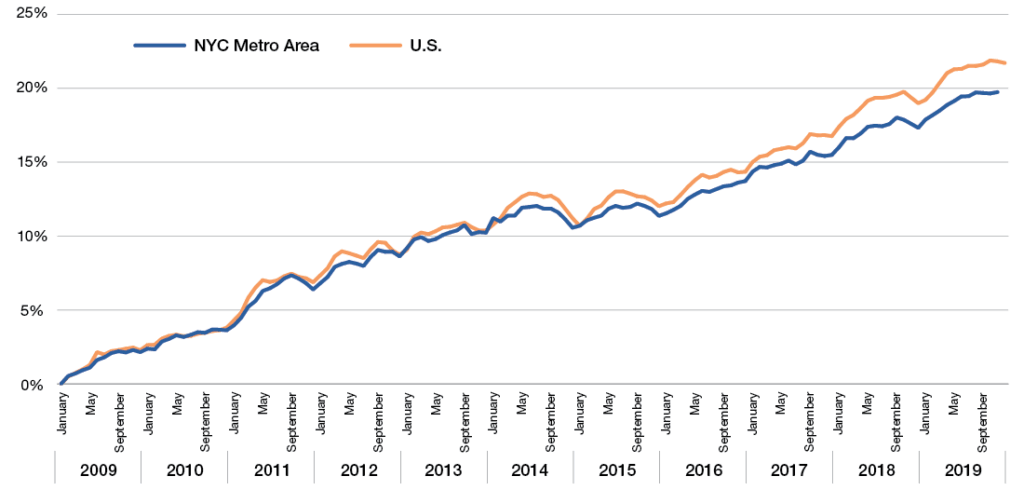

Why the Program Was Created: Inflation’s Persistent Effects

Despite improvements in national inflation rates, New Yorkers continue to experience significant cost pressures. According to the U.S. Bureau of Labor Statistics, the Northeast region has seen consistent increases in housing, food, and transportation costs over the past three years. Analysts say these increases have hit renters and middle-income families particularly hard.

Dr. Eleanor Marks, an economist at Columbia University, said the refunds reflect “a recognition that inflation has eased, but household budgets have not fully recovered. These payments provide short-term support at a time when economic strain remains elevated.”

Consumer watchdog groups, including the National Consumer Law Center, report that household debt across the state is at its highest level since before the Great Recession, intensifying pressure on state officials to act.

Legislative Background: How the Refund Was Approved

The refund program was one of the most debated components of the 2025–26 New York State Budget. Lawmakers held weeks of negotiations over whether the state should direct surplus tax revenue toward:

- Education funding

- Infrastructure upgrades

- Housing investments

- Direct payments to residents

Ultimately, legislators agreed to temporary, consumer-focused relief in the form of the Inflation Refund Checks, arguing it provided immediate benefits.

State Senator Michael Gianaris, a supporter of the measure, said during budget hearings that “families need assistance now, not in five or ten years. This refund gives people timely support.”

Some lawmakers opposed the measure, arguing the funds should have been directed toward long-term affordability initiatives.

How the State is Distributing the Checks

Mailing Timeline

Officials report:

- Processing began late September 2025

- Significant batches mailed through October and November

- The final wave expected before year’s end

The state emphasized that checks are not being mailed by region or ZIP code. Households within the same town may receive payments weeks apart.

Address Mismatches

A common issue involves taxpayers who moved after filing their 2023 return. The tax department urges residents to update their address using the NYS Online Services portal.

Acting Commissioner Amanda Hiller said the department “is working to ensure every eligible household receives the payment while minimizing delivery errors.”

Fraud Concerns and State Warnings

State officials issued warnings about increased scam activity. Some residents reported receiving texts or emails claiming they needed to “activate” their refund.

New York clarifies:

- It will not ask for bank information

- It will not contact residents by unsolicited text

- It will not request payment to release funds

Residents concerned about fraud can report activity to the New York State Attorney General’s Office.

How New York’s Refund Compares to Other States

Several states have issued similar inflation-related relief in recent years:

California

- Offered rebates up to $1,050 based on income

- Issued through direct deposit and debit cards

New Mexico

- Released $500–$1,000 checks in 2022 and 2023

- Extended eligibility to non-filers

Minnesota

- Provided relief centered on childcare and renter needs

Unlike these programs, New York chose a narrower, tax-return-based approach focused on returning sales-tax surplus revenue.

Policy analyst Jordan Sklar from the Rockefeller Institute of Government said New York’s approach “balances relief with fiscal prudence, but its targeted structure means some struggling residents may not benefit.”

Impact on Households: Who Stands to Gain the Most

Economic analysts say the benefits are most significant for:

- Rent-burdened households

- Families earning below $100,000

- Individuals facing elevated food and transportation costs

A review by the Urban Institute shows that one-time payments can provide temporary relief but have limited long-term economic impact unless paired with broader affordability measures.

Consumer advocate Maya Lopez of the Community Service Society of New York said, “For some families, $400 covers a week of groceries or a month of utility bills. It’s helpful, but it’s temporary.”

Administrative Challenges and Delays

Mail Delivery Delays

Officials acknowledge:

- Seasonal mail backlogs

- Staffing shortages

- Returned mail due to incorrect addresses

High Inquiry Volume

The tax department’s hotline and website have seen surges in traffic. Officials recommend residents check the department’s online FAQ, updated weekly.

Displaced Residents

New Yorkers displaced by rising housing costs or recent moves may face the greatest risk of delays.

Looking Ahead: Could the Refund Return Next Year?

State officials have not committed to renewing the refund program in future budgets. The decision will depend on:

- Revenue performance

- Inflation trends

- Political negotiations

Budget experts say the program’s future is uncertain given the state’s long-term financial obligations.

Dr. Marks of Columbia noted that “one-time refunds are politically popular during high inflation, but they are not guaranteed to repeat. Future budgets may prioritize structural affordability over temporary relief.”

Social Security Shifts Again: New Retirement Age Rules Replace the Old 67 Benchmark

FAQs About $400 Inflation Refund Checks

1. Do I need to apply?

No. Payments are automatic.

2. What if I moved?

Update your address with the NYS Tax Department immediately.

3. Are non-filers eligible?

No. Only residents who filed a 2023 tax return qualify.

4. When will my check arrive?

Most checks are expected to arrive before the end of the year.

5. Is the payment taxable?

State officials say the refund is non-taxable, but residents should confirm when filing federal returns.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores