2026 Social Security Tax Hike Targets Top Incomes—See How Much More You’ll Owe at $184,500 Limit

The Social Security wage base—the maximum annual income subject to the Old-Age, Survivors, and Disability Insurance (OASDI) tax—will climb to $184,500 in 2026, according to the U.S. Social Security Administration (SSA). The change means higher earners will contribute more to the system, even though the 6.2 percent tax rate remains unchanged.

2026 Social Security Tax Hike

| Key Fact | Detail / Statistic |

|---|---|

| 2026 Social Security wage base | $184,500 (up from $176,100 in 2025) |

| Employee OASDI rate | 6.2% (unchanged) |

| Maximum employee OASDI contribution | $11,439 in 2026 |

| Increase vs. 2025 | +$520.80 per employee |

A Routine Adjustment, Not a Policy Shift

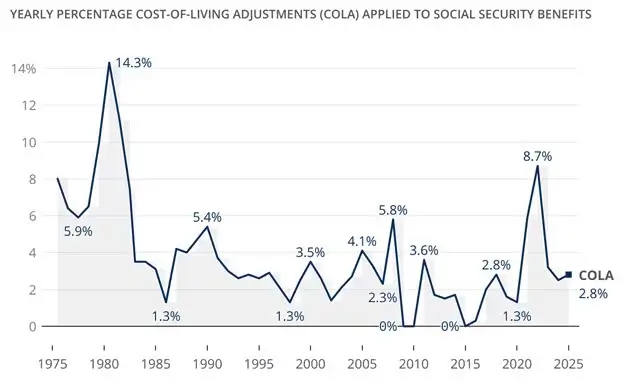

SSA officials emphasize that the increase is not a discretionary hike but an automatic adjustment tied to national wage growth. Each year, the taxable earnings cap rises in line with average wage index data compiled by the SSA. The 2026 adjustment represents a 4.8 percent increase over 2025’s $176,100 limit.

“This is a routine cost-of-living adjustment built into the Social Security framework,” said Andrew Biggs, senior fellow at the American Enterprise Institute. “It ensures the program keeps pace with wage trends while maintaining long-term solvency.”

What It Means for Workers

Employees earning less than $184,500 will continue paying the 6.2 percent Social Security tax on their full income. Those earning above that threshold will see more of their paycheck subject to the tax, up to the new cap.

For high earners:

- 2025 maximum OASDI tax: $176,100 × 6.2% = $10,918.20

- 2026 maximum OASDI tax: $184,500 × 6.2% = $11,439.00

That’s an increase of $520.80 in payroll taxes for anyone reaching or exceeding the wage base in 2026.

Self-employed individuals, who pay both the employer and employee portions (12.4 percent total), will owe up to $22,878 in 2026—roughly $1,041 more than in 2025.

“It’s important for self-employed professionals to budget for this,” said Janet Holtz, a certified public accountant in Chicago. “Even though the rate hasn’t changed, a higher wage base means a bigger tax bill.”

Medicare Tax Remains Uncapped

While Social Security contributions stop at the wage cap, the Medicare payroll tax applies to all wages, regardless of income. Employees pay 1.45 percent, with an additional 0.9 percent surtax on earnings above $200,000 for individuals or $250,000 for couples filing jointly.

That means the total combined payroll tax burden on top earners can reach 8.55 percent on portions of income above the Social Security cap—though only Medicare applies beyond that point.

According to the Internal Revenue Service (IRS), the surtax affects roughly the top 2 percent of earners nationwide.

Why the Wage Base Keeps Rising

The wage base increase reflects indexing to the National Average Wage Index (NAWI), a measure of overall earnings growth across the U.S. economy. When average wages rise, the taxable cap follows suit. This ensures Social Security benefits and revenue remain aligned with broader economic trends.

However, the adjustment also highlights a persistent challenge for the Social Security system: maintaining financial stability as the population ages.

The Social Security Board of Trustees reported in 2024 that the combined retirement and disability trust funds could be depleted by 2035 if no reforms are made. After that, incoming payroll taxes would cover only about 83 percent of scheduled benefits.

“Automatic wage indexing brings in additional revenue, but it doesn’t solve the structural shortfall,” noted Kathleen Romig, director of Social Security and Disability Policy at the Center on Budget and Policy Priorities (CBPP). “Broader policy changes will eventually be needed.”

Broader Economic Context

The increase to $184,500 comes amid sustained wage growth and elevated inflation in the aftermath of the pandemic. The U.S. Bureau of Labor Statistics (BLS) reported a 4.3 percent rise in average hourly earnings through mid-2025. Such gains feed directly into the SSA’s wage index calculations.

For most Americans, the wage base change will have no effect—nearly 90 percent of workers earn less than the taxable maximum, according to SSA data. However, for those who do, the impact can be noticeable.

High-income professionals in finance, technology, and healthcare are most likely to see their take-home pay dip slightly as a result of the new cap. Employers, who match employee contributions, will also see payroll costs rise proportionally.

“While the adjustment is modest, it’s a reminder that Social Security financing is an evolving system,” said Richard Johnson, director of the Urban Institute’s Program on Retirement Policy. “Workers and employers alike should understand how these automatic mechanisms operate.”

What Comes Next

The 2026 wage base adjustment will take effect January 1, 2026. Employers will need to update payroll systems before the new year to ensure compliance.

Congress has not announced any additional Social Security reforms, though both parties have proposed varying measures to address long-term funding. Options include lifting or removing the wage cap entirely, modifying benefit formulas, or adjusting eligibility ages.

For now, the 2026 Social Security tax hike remains a predictable by-the-numbers change, rooted in law rather than politics.

The Bottom Line

For most Americans, the 2026 wage base increase will pass unnoticed. For high-income earners, however, it marks a modest rise in contributions—roughly $520 more per employee and $1,041 for the self-employed.

While the adjustment strengthens Social Security’s revenue base, experts warn that deeper reforms will be necessary to secure the program’s long-term future.

FAQ

Q: Is this a new tax increase?

No. The rate remains 6.2 percent. The increase applies only to the maximum amount of earnings subject to the tax, which adjusts annually based on national wage growth.

Q: Who is affected?

Only workers earning above $176,100 in 2025 will pay more. Roughly 6 percent of U.S. workers are projected to reach the 2026 cap.

Q: Does this change my future benefits?

Potentially, yes. Higher taxed earnings may increase your future Social Security benefits, though only modestly, since benefits are calculated progressively.