The $2,000 Tariff Payment Proposal—a suggested plan to provide direct financial relief to millions of Americans using federal tariff revenue—has emerged as one of the most debated economic ideas of the year.

Backed publicly by former President Donald Trump and referenced by members of his policy team, the proposal aims to turn tariff collections into a form of national “dividend” for eligible households.

While the plan has not yet been formalized into legislation, discussions around who might qualify and how the program would interact with Social Security policies have accelerated as policymakers assess viability, cost, and political implications.

$2,000 Tariff Payment Proposal

| Key Fact | Detail |

|---|---|

| Proposed payment amount | $2,000 per eligible person |

| Potential funding | Federal tariff revenues |

| Tentative eligibility | Up to ~60% of U.S. households |

| Implementation status | Proposal stage, no legislation |

Understanding the $2,000 Tariff Payment Proposal

The idea behind the $2,000 Tariff Payment Proposal is straightforward in messaging but complex in legal and fiscal execution. Under the concept outlined by supporters, the federal government would collect revenue from tariffs imposed on imports and then redistribute a portion of those funds as direct payments to qualifying Americans.

Advocates describe the plan as a mechanism for ensuring that tariff costs—often felt by consumers—are partly offset by government-backed rebates.

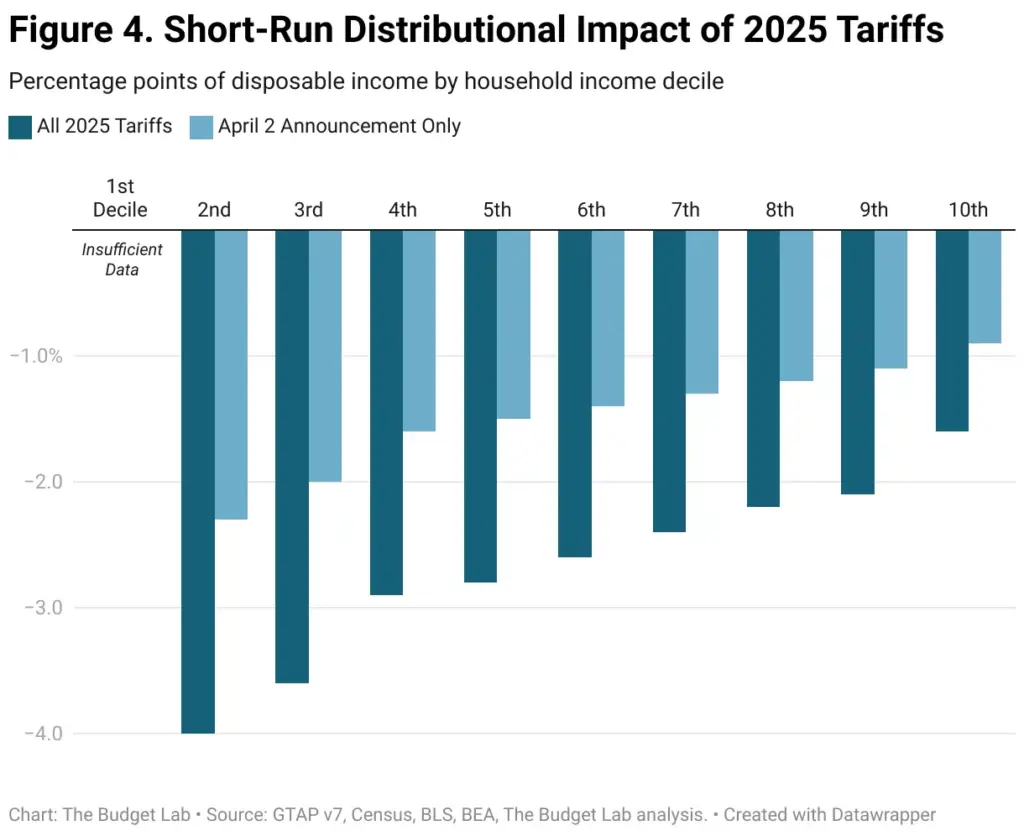

Policy advisers close to the proposal say the payment is intended to “reward American households” while reinforcing the administration’s long-term tariff strategy. Critics argue, however, that tariffs function as indirect taxes on consumers and may raise prices on essential goods, complicating the policy’s benefits.

Who Would Likely Qualify for $2,000 Tariff Payment?

Although no formal eligibility rules exist yet, early signals from policymakers, economists, and financial agencies point to several likely criteria.

Households Under a Certain Income Threshold

Public statements suggest the administration is evaluating an income limit of approximately $100,000 per household, a level that would include lower- and middle-income Americans but exclude high-earning individuals. Analysts estimate this would cover 50–60% of U.S. households, making it one of the most broadly targeted federal economic proposals in recent years.

Individual vs. Household Qualification

A key unresolved question is whether the $2,000 would be issued:

- per adult,

- per tax filer, or

- per household.

Early language used by supporters suggests per person, but internal discussions reportedly consider a household-based model to reduce costs.

Treatment of Children and Dependents

Unlike previous stimulus programs that included payments for dependents, the tariff proposal does not yet specify whether households with children would receive additional funds. Economists warn that including dependents would significantly increase overall program cost.

Citizenship and Residency Requirements

Although not explicitly discussed publicly, most federal payment programs require recipients to:

- Be U.S. citizens or permanent residents,

- Possess valid Social Security numbers,

- And file U.S. tax returns within a given timeframe.

These criteria would likely apply here as well.

Tariff Rebate Eligibility (KW2) — How Revenue Would Determine Who Gets Paid

The structure of tariffs complicates tariff rebate eligibility. Tariffs are collected on imported goods, but their final economic burden often falls on U.S. businesses and consumers. If the program is truly funded through tariff revenue, eligibility criteria may depend not only on income but also on projected federal collections.

Research from economic think tanks indicates that current tariff revenue might not be sufficient to fund universal $2,000 rebates. As a result, policymakers may need to narrow the eligible population or cap the total annual distribution.

Although some public statements link the proposal to Social Security, the plan does not modify Social Security benefits directly. Instead, supporters frame it as a way to provide relief without drawing from Social Security trust funds, thereby avoiding further strain on a program already facing long-term solvency challenges.

The Social Security funding debate has intensified in recent years as projections show trust-fund reserves may diminish in the early 2030s. Analysts note that any federal program promising cash payments must consider interactions with benefit programs such as Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI).

Key questions include:

- Would the tariff payment count as taxable income, potentially reducing means-tested benefits?

- Would Social Security beneficiaries qualify, given many are in the target income range?

- Would the program create administrative overlap with existing federal benefit infrastructures?

Experts stress that any new federal payment program must clarify its impact on older adults, disabled workers, and low-income families.

Economic Stimulus Payments (KW4) — Could This Act Like a New National Stimulus?

Economists evaluating the proposal say the payments would function similarly to economic stimulus payments issued during past recessions and emergencies. The impacts would depend on:

- Household savings rates,

- Consumer spending behavior,

- Inflation,

- And timing of distribution.

Supporters argue $2,000 payments would boost short-term spending and help families manage higher costs caused by tariffs. Critics counter that tariffs often drive up prices, meaning households could face higher costs before receiving any benefit.

A report from an independent fiscal institute notes that the payment might “return only a portion of what consumers already lose in increased import costs,” suggesting limited net benefit unless structured carefully.

Legal Challenges and Feasibility Questions

Multiple legal and logistical challenges complicate the proposal:

Tariff Legality Under Review

Several tariffs generating revenue for the plan are currently under review in federal courts. If courts rule against the legality of certain tariffs, the government may be required to refund tariff revenue, reducing available funds for payments.

Congressional Approval Required

Even if the administration supports the proposal, Congress must authorize federal payments of this scale. Current partisan divides suggest uncertain legislative pathways.

Administrative Capacity

Any national payment system requires:

- Income verification,

- Bank-account validation,

- Fraud detection safeguards,

- Collaboration across Treasury, IRS, and SSA systems.

Sources familiar with IRS operations say implementation could take nine months to one year after legislation is enacted.

Expert Commentary

Dr. Lena Rodriguez, Senior Economist at Georgetown University

“Turning tariffs into direct payments is theoretically possible but practically difficult. The revenue is unstable, and legal risks remain unresolved.”

Former Treasury official Mark Delaney

“If eligibility targets households under $100,000, millions of Social Security recipients could qualify. But policymakers must ensure payments do not inadvertently reduce means-tested benefits.”

Brookings Institution Trade Analyst Claire Milner

“Economically, tariffs raise consumer prices. Payments may help offset that burden, but they do not eliminate it.”

Public Opinion and Political Dynamics

Surveys conducted by non-partisan research groups show:

- 63% of Americans support the idea of a $2,000 federal payment,

- Support rises to 76% among households earning under $75,000,

- But only 45% support tying the payments to tariff revenue specifically.

Politically, the proposal has polarized lawmakers. Some view it as innovative redistribution, while others call it fiscally unsustainable.

Implementation Scenarios

Scenario 1: Income-Capped Direct Payments

Most likely implementation. Payments go to adults under a specific income threshold.

Scenario 2: Universal Payment but Smaller Amount

Payments issued broadly but reduced to ensure revenue sufficiency.

Scenario 3: Tax Credit Instead of Cash Payment

Credits applied during tax filing rather than direct stimulus-style checks.

Scenario 4: Social Security Beneficiary Add-On

Beneficiaries receive an additional payment if the plan is paired with other benefit reforms.

Related Links

COLA Cap Proposal Targets High-Earning Seniors — Here’s Who Might Lose Out

$5,108 Direct Deposits Are Rolling Out This Week — See If Your Bank Account Is Getting Hit

While the $2,000 Tariff Payment Proposal has captured widespread attention, substantial uncertainty remains. Legislative approval, tariff stability, administrative capacity, and broader debates around federal spending and social programs will determine whether the proposal evolves into a national payment program or remains a high-profile policy idea in a contentious economic environment.

FAQ About $2,000 Tariff Payment

Q: Would Social Security beneficiaries qualify?

Likely yes, depending on income. Most retirees fall under proposed thresholds.

Q: Is the payment guaranteed?

No. It remains a proposal, not law.

Q: Are children included?

Unclear. No official guidance.

Q: Is the payment taxable?

Not yet determined. Past stimulus payments were not.

Q: When could payments realistically begin?

Not before mid-2026, assuming swift legislative action.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores