The Alaska Department of Revenue (ADR) has confirmed that eligible residents will receive automatic $1,000 payments under the 2025 Alaska Permanent Fund Dividend (PFD) program. The next major deposit date is November 20, 2025, part of the state’s annual oil-revenue distribution to all qualifying Alaskans.

$1,000 Payments Confirmed for Alaska Residents

| Key Fact | Detail / Statistic |

|---|---|

| Payment Amount | $1,000 per eligible resident |

| Next Deposit Date | November 20, 2025 (for “Eligible-Not Paid” applications as of Nov 12) |

| Application Deadline | March 31, 2025 |

| Fund Value | $78 billion as of 2025 |

| Number of Expected Recipients | 600,000+ Alaskans |

What Is the Alaska Permanent Fund Dividend?

The Permanent Fund Dividend (PFD) represents one of the most distinctive wealth-sharing systems in the world. It redistributes part of Alaska’s oil and mineral revenues directly to residents, a policy rooted in the 1976 constitutional amendment that created the Alaska Permanent Fund.

The fund’s earnings are invested globally by the Alaska Permanent Fund Corporation (APFC), with a portion of the returns used for annual dividends. According to the Department of Revenue, the fund reached $78 billion in value this year, maintaining its role as one of the largest sovereign wealth funds in the United States.

Economist Dr. Mouhcine Guettabi, formerly of the University of Alaska Anchorage’s Institute of Social and Economic Research (ISER), calls the PFD “a social contract that returns resource wealth directly to citizens.”

Deposit Schedule and Payout Waves

The Department of Revenue has published an updated payment timeline:

- November 20, 2025 – For applications in “Eligible-Not Paid” status by November 12

- December 18, 2025 – For applications cleared by December 10

- January 15, 2026 – For remaining eligible applicants

Payments are made automatically through direct deposit or mailed checks. Recipients can verify status by logging into myAlaska and selecting “myPFD” on pfd.alaska.gov.

Who Is Eligible for $1,000 Payments Confirmed for Alaska Residents

To receive the 2025 Automatic $1,000 Payment, applicants must:

- Have lived in Alaska for the entire 2024 calendar year and intend to remain indefinitely.

- Not have been absent from the state for more than 180 days, except for approved reasons (education, military service, or medical care).

- Have no felony incarceration during the qualifying year.

- File their application by March 31, 2025.

Each eligible person—including minors—receives an equal amount. Parents or guardians may file on behalf of dependents.

Why the 2025 Payout Is Smaller

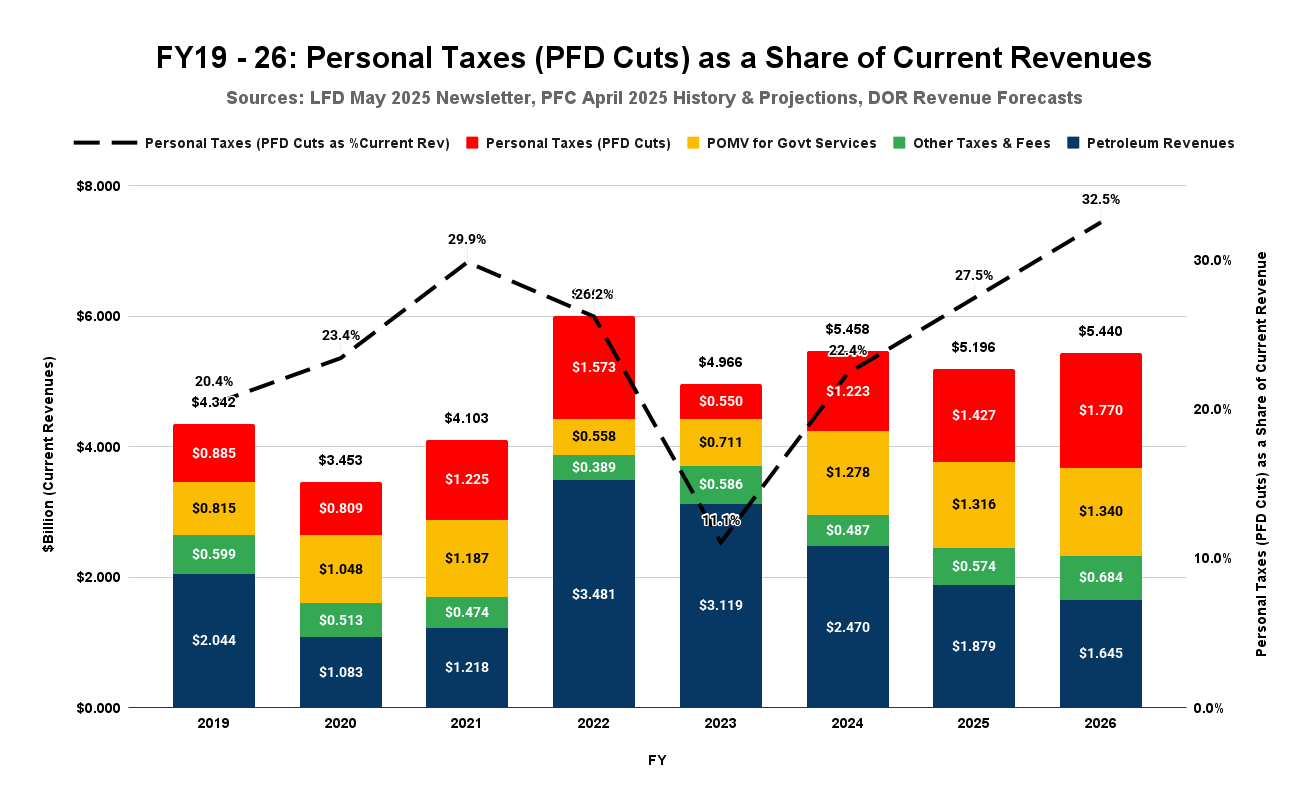

The 2025 dividend of $1,000 is smaller than the $1,312 distributed in 2024 and far below the record $3,284 in 2022. According to ADR Commissioner Adam Crum, the reduced payout reflects lower energy revenues and a “balanced approach between citizen payments and public spending.”

“The dividend remains an essential benefit,” Crum said during a September briefing. “However, we must preserve the fund’s long-term sustainability while ensuring the state’s fiscal health.”

Economic and Social Importance

For many Alaskans, the annual dividend is more than a financial bonus—it’s a lifeline. The payout arrives just before the holiday season and as winter energy costs rise, providing critical support for families in remote and high-cost areas.

According to ISER research, the PFD reduces poverty rates in rural Alaska by up to 20% during high-dividend years. It also injects millions into local economies, boosting retail and service spending during the winter months.

Rural resident Diana Killigrew from Bethel said the annual payment “covers heating fuel and groceries that otherwise wouldn’t fit our winter budget.”

Yet not all Alaskans agree on the program’s size. Some lawmakers advocate for larger dividends, while others push for reduced payouts to bolster public services like education and transportation.

“The PFD has to coexist with funding schools, health care, and roads,” said Senator Bert Stedman, co-chair of the Senate Finance Committee. “We can’t spend more than we earn.”

Historical Context and Legal Framework

The first dividend, paid in 1982, amounted to $1,000—the same as today’s 2025 payment. Since then, the amount has fluctuated based on oil prices, fund investment returns, and legislative formulas.

In 2018, Alaska adopted a Percent of Market Value (POMV) model, capping annual withdrawals from the fund at roughly 5% of its market value to protect long-term growth. The model continues to fuel debate over whether dividends should have a guaranteed formula or remain at legislative discretion.

“The POMV rule stabilized finances, but it also tied the dividend to broader political negotiations,” said Dr. James Brooks, an energy policy expert at the University of Alaska Fairbanks.

Confirm and Protect Your Payment

Residents should monitor the status of their applications at pfd.alaska.gov using their myAlaska login. The Department warns against phishing scams that mimic state correspondence.

“The Department of Revenue will never request personal bank details by text or email,” said Michelle Egan, the ADR’s communications director. “Always verify that you’re on an official Alaska.gov domain.”

Comparisons and Global Context

Alaska’s PFD remains one of the few examples of universal, unconditional payments tied to natural resource wealth. Economists often compare it to Norway’s Government Pension Fund Global, which distributes benefits indirectly through social programs rather than direct cash payments.

“While Alaska’s dividend is smaller, it demonstrates the viability of equitable wealth sharing in resource-rich economies,” said Dr. Karen Hooper of the Brookings Institution.

Related Links

IRS Unveils 2026 Tax Brackets — Here’s How Inflation Could Affect Your Take-Home Pay

SSA Beneficiaries in 10 States Set for Bigger Checks — Check Why and How Much You’ll Get

Future Outlook

Lawmakers are expected to revisit the dividend formula in 2026 amid growing calls to balance sustainability and equity. The debate centers on whether Alaska can maintain both robust citizen payouts and essential public services if oil revenues continue to decline.

A legislative report projects that under moderate oil prices, future PFDs could stabilize between $900 and $1,200 annually, barring major fiscal changes.

“The dividend’s future depends on fiscal discipline and diversified revenue,” said David Teal, former legislative fiscal analyst. “It’s a choice between short-term politics and long-term prosperity.”

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores